Can You Get Two Car Loans at Once

This post may contain affiliate links. Which means we may earn a commission if you decide to make a purchase through our links. Please read our disclosure for more info.

Buying a car is not easy for a mid-range income earner. Most people rely on financing to buy a car. However, there'll be a time in your life when you'll need to buy two cars, or more. Perhaps, you and your spouse both need cars. Your child might be going to college, and you want them to have a car. Regardless of why you need to have two vehicles, financing will always be your top priority/consideration.

Car financing takes years to pay off, depending on your monthly installments. But, situations may arise when you need to finance another car through debt. Will that be possible? Is this an allowed practice? If yes, how can one get this?

The short answer to the first question is that it is not usual or common to have 1 financing arrangement on two cars in one loan.

In this article, we'll explore more on this topic. We'll tackle the essential details that every consumer in this situation needs to know.

Can You Finance Two Cars at Once?

As mentioned above, it is not usual or common to have 1 financing arrangement on two cars in one loan. Most dealers out there would grant an auto loan for a specific vehicle as that particular car acts as a collateral to ensure you pay your loans timely. However, it's easier to get another car but with a different financing arrangement. The thing here therefore is that you'll have two auto loans that may charge different interest rates, payment schedules, and loan terms.

If a car dealer approves two auto financing agreements, it must mean that you're an excellent debtor with a very credible credit history. But in most cases, it's a "one-is-to-one" basis in terms of auto financing. The scenario of financing several vehicles at once is more viable for large corporations than for individuals unless you belong to the super-rich.

But if you're a mid-range income earner, financing two cars in one auto loan is nearly impossible. If it does happen it would be if you have a stellar credit reputation so there is little or no risk to the lender. However, even if this option is not possible, there's this thing called "debt consolidation," wherein you're combining car loans into a single loan. In the succeeding sections, we'll talk about debt consolidation in detail.

Key Points

To summarize, here are some key points:

- Auto loans only finance one car. Two cars for one loan is not usual.

- It's possible to get two cars in separate auto loans.

- Debt consolidation is a viable option

How About Having 2 Separate Loans?

Another alternative that can work to obtain two cars is by getting two separate loans. But isn't that what's mentioned in the previous section? What we talked about in the last section was getting two auto loans. Meaning it's two loan agreements that finance a car. In this section, we are talking about 2 different types of loans.

Instead of getting two auto loans, you can apply for an auto loan and a personal loan. These two loans are different. In the case of a personal loan, you can use the proceeds to buy a car. After all, personal loans can be used for a variety of purposes. Unlike an auto loan, the proceeds are restricted for purchasing a car. Hence, you can use a personal loan to buy a vehicle without bank restrictions regarding its use.

Major Drawbacks of Having a Personal LOan

Yes, a personal loan can finance your second car. However, personal loans often have limits depending on your credit score and credit history. NerdWallet says that loan amounts can range from $1,000 to $100,000. You may think that $100,000 is more than enough for a car purchase. But, banks won't easily disburse a personal loan of that amount. Even so, a loan less than $100,000 is already quite hard to get approved.

Aside from that, personal loans often have high-interest charges and penalties. Given that it's flexible, personal loans aren't cheap. And more importantly, personal loans increase your debt which could raise some concerns in your credit history if potential lenders were to review that.

Should You Pursue This?

Every action has its benefits and drawbacks. In the end, it all boils down to your financial capacity. Hence, we recommend that you assess your financial situation right now and your future income potential. This setup is workable as long as you have the financial capacity to do so.

What Is Debt Consolidation?

Debt consolidation is the process of combining all your debt into a single obligation. To consolidate several debts, you need to pay off the existing debt by using the proceeds of newer debt. For example, Joanne has three debts: a personal loan from her friend Mary, credit card dues, and a short-term bank loan. All of her obligations amount to $15,000. To consolidate her debt, Joanne gets a new loan in the amount of $20,000.

She then uses the proceeds to pay Mary, her credit cards, and the bank. Now, Joanne is left with only one loan. Hence, she's only obligated to one creditor instead of three. The main benefit you can get from debt consolidation is the convenience of payment. Instead of going to three creditors, you only pay one person.

How To Consolidate Your Auto Loans?

You might ask, "Can I get a second car loan if I already have one?" Yes, you can! And if you want to reduce finance charges, you can consolidate them into one loan. Combining car loans can work if you have a pre-existing car loan and a new one. Consolidating it can make it easier for you to pay, and it can reduce finance charges. Here are some helpful steps to follow in consolidating your auto loans:

Step 1: Check the status of your current auto loans

In checking your current loans' status, you need to look at the outstanding balance, remaining loan term, and annual percentage rates. A likely scenario is that one of your auto loans has been running for quite some time. Then, check the remaining number of payments. If your earlier loan is already close to its final payment, you may just have to keep the status quo until the final payment. But if you still have more than 12 monthly payments remaining, you can consider consolidation.

Now, how can you use the current information to get a debt consolidation? First, get the sum of your outstanding principal balances. Then, compute the weighted-average interest of all your loans. Here's a quick example (note that you can use the amortization schedule given below to do the calculations so you need not get too concerned if the formula is too complicated):

Martha has two auto loans:

- Car A financed by a six-year loan for $20,000 with annual percentage rates of 5%. Based on the amortization schedule, the outstanding principal balance is $5,275, with 18 payments remaining.

- Car B financed by a five-year loan for $30,000 with annual percentage rates of 6%. Based on the amortization schedule, the outstanding principal balance is $24,695, with 48 payments remaining.

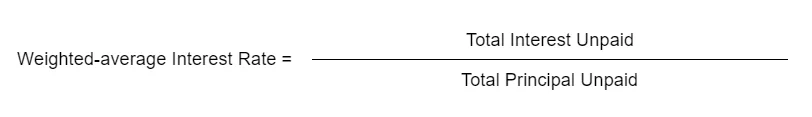

If Martha wants to consolidate her auto loans, she needs to borrow at least $29,970 to pay both loans. Martha can estimate the interest by computing the weighted-average interest rate by using the formula below:

The formula above is for decision-making purposes only. It aims to provide a benchmark so that you'll know the best interest rate for your new loan.

Now, if you use the links above for the amortization schedules to calculate, the total interest for Car A and Car B would be $223 (starting at 55th payment) and $3,143 (starting at 13th payment), respectively. The total principal unpaid for Car A and B is $5,276 and $24,239 respectively.

Hence, the weighted-average interest rate is 11.40% ($3,366 ÷ $29,515) based on current amortization values.

DECISION POINT: Theoretically, Martha should aim for an interest rate below 11.40% if she wants to save on the consolidation. Anything above that rate is disadvantageous to her.

Step 2: Review your credit report

Before going to the financial institution, make sure that you've checked your credit report. How's your credit score? Is it high enough to get a new loan? You can reach out to Equifax, TransUnion, or Experian for a copy of your credit report.

Step 3: Look for a lender

Once you're good to go, you can start looking for lenders. Check out websites of banks, credit unions, or private financial services around your area. Inquire about their lending services. Your goal here is to look for the most affordable loan offer. Do not apply to multiple lenders as this may trigger a hard inquiry on your credit report and adversely affect your credit score.

Step 4: Choose the best offer

Always remember that what seems like the best offer is not necessarily totally advantageous – it will depend on your situation. For example, Martha got a quote from two financial institutions. Company A is willing to give her a five-year loan with an interest of 8% and a principal of $25,000. Company B countered by giving her an eight-year loan with interest of 12% and a principal of $30,000.

If Martha wants to save on interest payments, Company A is best for her. However, Company B's offer is attractive if she wants a larger loan, a longer time to pay, and to consolidate the debt entirely.

What Happens If I Default on Payments?

After consolidating your auto loans, the individual car dealers would have already been paid off. Meaning they cannot repossess your car anymore since you do not owe them any money so there is nothing to default on. However, the new creditor that gave you the consolidated loan may ask your two cars to be collaterals to the new loan. In case of default, the new creditor may penalize you depending on the loan agreement's terms. In a worst-case scenario, your cars can be repossessed since both are collateral to the new loan.

Does Debt Consolidation Hurt My Credit Score?

According to NerdWallet, debt consolidation can cause a drop in your credit score. Creditors may be uncomfortable to see a considerable sum of debt to pay off several loans. However, you can recover from it as long as you pay religiously on your current obligations. It'll take several months to recover, but it'll be alright as long as you stay faithful to your course of timely and full payments each time.

In Conclusion

So, can you finance two cars in one loan? It is unusual and uncommon for individuals. There are other possible options you can opt for. Auto loan consolidation is a good option if you want a convenient payment system. It is worth it if you are financially capable of paying off your loans. The important consideration is what is the best option available to you based on your current financial situation and what are the consequences if you fail to meet your payment obligations.

Can You Get Two Car Loans at Once

Source: https://houseofdebt.org/can-you-finance-two-cars-on-one-loan/

0 Response to "Can You Get Two Car Loans at Once"

Post a Comment