How Soon After Getting a Car Loan Can You Refinance

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn't affect our editors' opinions. Our marketing partners don't review, approve or endorse our editorial content. It's accurate to the best of our knowledge when posted.

Advertiser Disclosure

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

Have you taken out an auto loan to pay for your car? You may be able to refinance that loan to lessen your financial burden.

Refinancing a car loan involves taking on a new loan to pay off the balance of your existing car loan. Most of these loans are secured by a car and paid off in fixed monthly payments over a predetermined period of time — usually a few years.

People generally refinance their auto loans to save money, as refinancing could score you a lower interest rate. As a result, it could decrease your monthly payments and free up cash for other financial obligations.

Even if you can't find a more favorable rate, you may be able to find another loan with a longer repayment period, which might also result in a lower monthly payment (although it might increase your total interest cost over the life of the loan).

If you're still unsure whether refinancing a car loan is right for you, read on to learn about when it typically makes the most sense.

When should you refinance your car?

A decision as big as auto refinancing will depend on a number of individual factors. With that said, you may want to give it some extra-serious thought in the following instances:

Interest rates have dropped since you took out your original auto loan

Interest rates change regularly, so there's a possibility that rates have fallen since you took out your original auto loan. Even a drop of 2 or 3 percentage points may result in significant savings over the life of your loan.

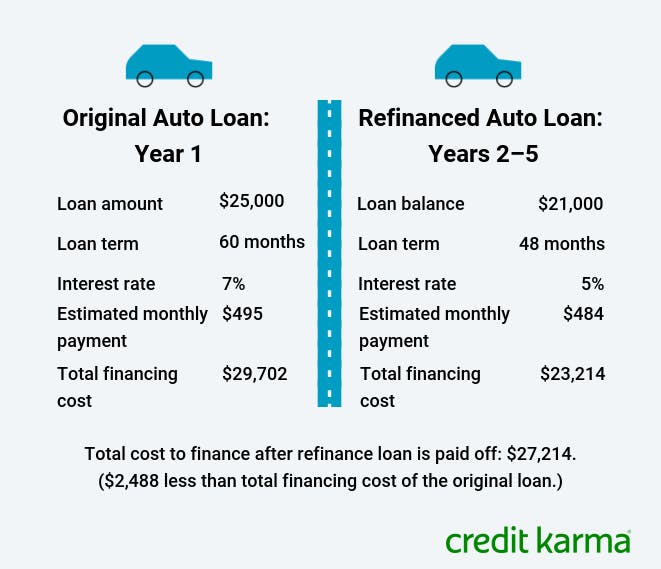

Image: aaupdaterefinancing-1

Image: aaupdaterefinancing-1 Let's say your original auto loan was for $25,000, with a 7% interest rate and loan term of 60 months. If you keep this loan, you'll end up paying a total of $29,702 on the loan. After a year of payments on this loan, your balance is now $21,000. If you were to refinance and get a loan for $21,000 for the remaining 48 months with a lower interest rate of 5%, you'd end up paying a total of $23,214 on your refinance loan. Combined with the $4,000 you paid on the previous loan, you'd have paid a total of $27,214 to finance your car — $2,488 less than if you had kept your original loan.

Your financial situation has improved

Lenders can use a number of factors to decide your auto loan rate, including your credit scores and debt-to-income (DTI) ratio, which is calculated by dividing your monthly income by your monthly debt payments.

As such, improving your credit health and decreasing your DTI ratio can lead to more-favorable terms on your refinanced loan.

You didn't get the best offer the first time around

Even if interest rates haven't dropped or your financial situation hasn't improved significantly, it may be worth shopping around for better loan terms anyway. For example, you may have received a loan with an interest rate of 7% when other lenders were offering lower rates.

This may be especially wise if you got your original loan from a car dealer, as dealers sometimes offer higher interest rates to make extra money.

You're having trouble keeping up with bills each month

Even if you're not able to secure a lower interest rate, it may still be worth trying to find a loan with a longer repayment period in order to reduce your monthly car payments.

If you can't find a suitable loan, you may also be able to renegotiate the repayment period on your current loan. But keep in mind that more time spent paying back your loan is also more time spent paying interest. In general, you'll pay more interest overall if you have a loan with a longer term.

When should you hold off on refinancing?

Refinancing a car can save you money, but it's not always the best option. You may want to hold off on refinancing if any of these scenarios apply to you.

You've already paid off most of your original loan amount

Interest is often front-loaded, meaning you pay more of it off in the beginning. The longer you wait to refinance, the less you may be able to save on interest.

Your car is old or has a significant amount of miles on it

Cars depreciate quickly, so you'll likely only be able to refinance within the first few years of owning your car. Some lenders won't refinance cars that are over a certain age or mileage. For example, some banks won't refinance cars that are older than seven years or have more than 90,000 to 125,000 miles on them.

The fees outweigh the benefits

It's important to look out for any fees associated with refinancing. For example, there may be prepayment penalties for paying off your current auto loan earlier than planned with your refinance loan. You may have to pay some additional interest in addition to the principal.

Even worse, some loans, such as loans with precomputed interest, make you pay all of the interest in addition to the principal.

You're also likely to incur refinance fees. These can include lien holder and state re-registration fees. While they're not enormously expensive, it might be a good idea to see if you can afford these fees before you refinance.

You're looking to apply for more credit in the near future

An auto refinance could negatively impact your credit. If you're considering applying for a mortgage or that really exclusive credit card you've had your eye on, you may want to hold off on an auto loan refinance to keep your scores as high as possible and maintain your chances of being approved.

Next steps

Refinancing can save you money in interest or stretch out your loan payments, but you should only consider it when the circumstances are right.

If interest rates are lower or your financial situation has improved, it may be worth shopping around for a loan with better terms. If your credit scores haven't gotten better but you want to refinance, it may still be possible. Check out our article on how to refinance a car loan to learn more about the refinance process.

Auto debt and financing during the coronavirus crisis

If your finances have taken a hit because of COVID-19, you may be worried about making payments on your auto loan. You may also be looking to refinance your car loan to lessen your financial burden or take advantage of lower interest rates.

Many lenders have announced relief measures that could help. Check out our guide that explains what many auto lenders are doing to assist borrowers during this time. And you can shop and compare different auto loan refinancing options on Credit Karma to get a better sense of what's available and whether it makes sense for you.

How Soon After Getting a Car Loan Can You Refinance

Source: https://www.creditkarma.com/auto/i/refinancing-car-loan

0 Response to "How Soon After Getting a Car Loan Can You Refinance"

Post a Comment